The 3D printing market in Russia is witnessing significant growth, driven by advancements in technology and the increasing demand for customized manufacturing solutions. As more industries in Russia adopt 3D printing, the sector is expanding rapidly, with key players like OZON and Wildberries (WB) leading the way in online sales. This article provides an analysis of the current state of the Russian 3D printing market, its key players, trends, and the competitive landscape.

Market Overview

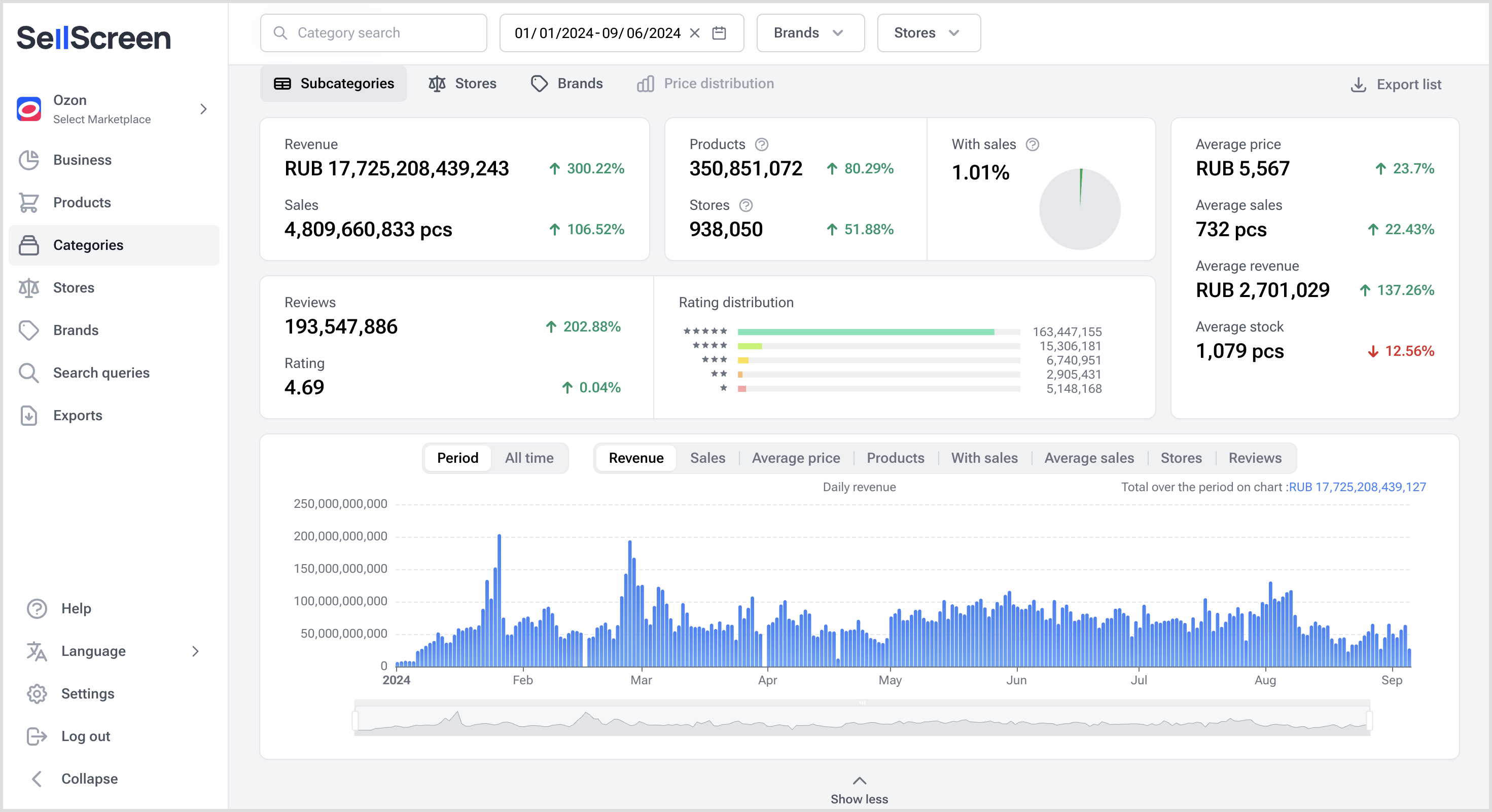

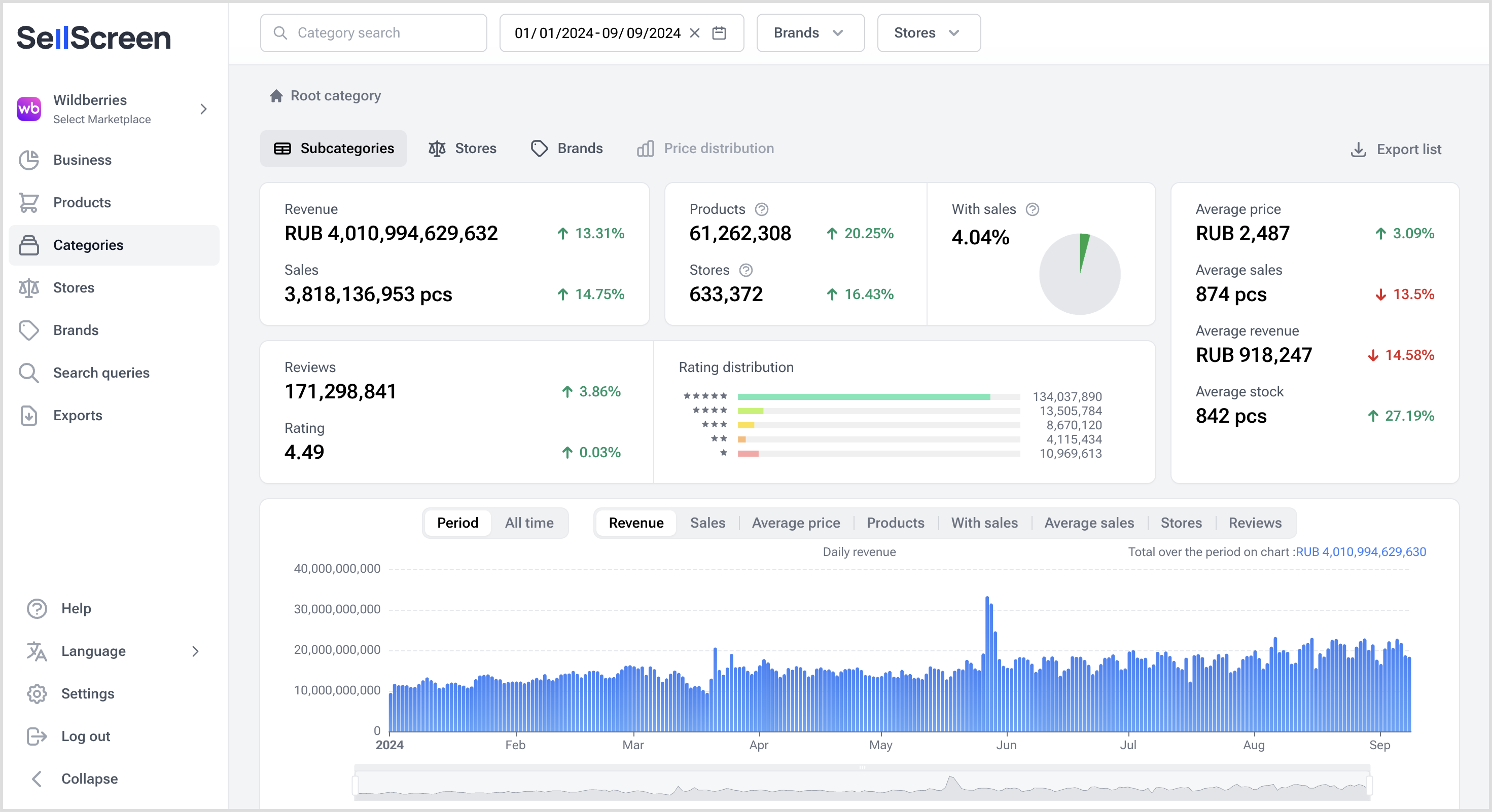

In recent years, the Russian 3D printing market has grown substantially, with online platforms playing a pivotal role in driving sales. Two major platforms dominate the online market: OZON and WB. OZON focuses on high-tech products, particularly in the electronics category, while WB is known for daily consumer goods, with women’s products being the most significant segment.

The market for 3D printers on these platforms is growing rapidly, and the disparity between them is notable:

• OZON: This platform leads in sales and product variety, holding a significant portion of the market share. The average price of 3D printers on OZON is much higher than on WB, reflecting OZON’s focus on high-end products.

• WB: Although WB sells fewer 3D printers than OZON, it makes up for this with a more extensive selection of 3D printer accessories.

3D Printer Sales Growth

The market has shown steady growth over the past few years, with sales in 2024 projected to rise even further. Based on the data provided, the 3D printer sales revenue on OZON has skyrocketed, with a forecasted revenue of 3,057,703,193 RUB by the end of 2024, marking an impressive growth rate of 138%.

In comparison, WB’s sales growth is stabilizing, and while it covers products under 70,000 RUB, its impact is smaller in terms of 3D printer unit sales compared to OZON.The difference in pricing between the two platforms is stark, with OZON’s average 3D printer price at 40,170 RUB, compared to WB’s 14,841 RUB. This price gap reflects the platforms’ different customer bases and product offerings, with OZON catering to higher-end, professional-grade printers and WB focusing on more affordable options.

Market Segmentation

In terms of product offerings, OZON boasts a broader range of 3D printers and related products. In 2024, the platform listed 8,578 different products, compared to 727 on WB. Additionally, OZON had 3,081 stores offering 3D printers, while WB had 234. This further underscores OZON’s dominance in the high-tech segment of the 3D printing market, where variety and specialization are essential.

From a price range perspective, OZON offers a diverse selection of 3D printers across various price points. This range is less visible on WB, which focuses primarily on lower-priced models, although it compensates by offering a wide array of accessories that rival the volume of actual 3D printer sales.

Competitive Landscape

The Russian 3D printing market is highly competitive, with both global and local brands vying for market share. According to the latest data, CREALITY leads the market with a 26% share, followed by ANYCUBIC at 14%, and Bambu Lab at 9%. Other notable players include Flyingbear and Elegoo, each holding around 7% of the market.

Interestingly, the top five brands control 63% of the market, indicating a strong concentration of market power among a few players. However, many smaller brands, categorized under “Others,” still make up a significant portion of the market at 37%. This suggests that while established brands dominate, there is still room for smaller, niche players to carve out a space in the market, especially as demand for specialized or affordable 3D printers grows.

Store Performance on OZON

In terms of sales distribution across stores, OZON’s platform features several prominent stores that contribute significantly to the overall sales. The top-performing store, lider-3d, has reported sales of over 407 million RUB. The performance of these stores highlights the importance of brand recognition and specialized offerings in the competitive 3D printing market.

While the top stores like lider-3d is performing well, there are also numerous smaller stores that contribute to the market. These stores tend to focus on specific niches within the 3D printing sector, offering unique products or accessories that cater to particular customer needs.

Future Trends and Opportunities

As the Russian 3D printing market continues to grow, several trends are becoming apparent:

1. Increasing Adoption Across Industries: 3D printing is increasingly being used across various sectors, including healthcare, automotive, aerospace, and construction. This trend is expected to continue as the technology becomes more accessible and cost-effective.

2. Customization and On-Demand Manufacturing: The ability to produce customized products on-demand is one of the key advantages of 3D printing. This trend is expected to drive further growth, particularly in industries where customization is critical, such as healthcare and fashion.

3. Emerging Technologies: As new 3D printing technologies emerge, the market is likely to see a shift towards more advanced applications. Innovations such as multi-material printing, metal 3D printing, and bio-printing are expected to open up new opportunities in the market.

4. Growing Demand for Accessories: With the increase in 3D printer sales, the demand for accessories such as filaments, nozzles, and maintenance tools is also rising. Platforms like WB, which focus heavily on accessories, are well-positioned to capitalize on this trend.

Conclusion

The Russian 3D printing market is experiencing rapid growth, particularly on e-commerce platforms like OZON and WB. While OZON dominates in terms of high-end products and overall market share, WB holds its own by offering a broad range of affordable accessories. With the market projected to continue expanding and new technologies on the horizon, there are ample opportunities for both established brands and new entrants to thrive.

As industries increasingly adopt 3D printing, and as customization becomes more critical, the Russian market is poised for continued growth, driven by both technological advancements and consumer demand for innovative manufacturing solutions.

Leave a comment